- 업종분석

- 매트릭스 분석

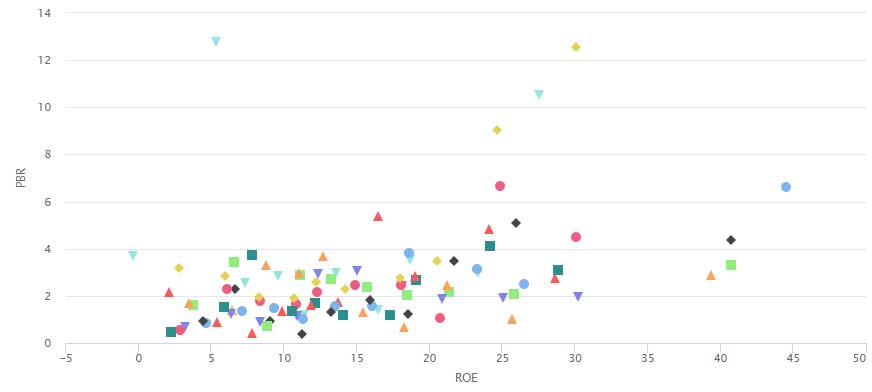

- 고ROE & 저PBR

동종산업에서 수익성이 높고 저평가된 기업을 한 눈에 비교, 확인할 수 있습니다. 업종내에서 ROE가 높고, PBR이 낮은 기업을 찾으면 됩니다.

아래 화면을 똑같이 4개로 분할 할 경우, 4사분면인 오른쪽 하단 영역에 위치한 기업들이 수익성은 좋고 저평가 된 기업입니다.

- 전체

- 업종 반도체

- 시가총액 전체

- 이익 전체

""에 대한 검색결과가 없습니다.

| 순위 | 종목 | ROE(%) | PBR(%) | 최근 5년간 ROE(%) | 분기 주당순이익(EPS)(원) | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 현재 | 3년 평균 | 5년 평균 | 현재 | 3년 평균 | 5년 평균 | 2025 | 2024 | 2023 | 2022 | 2021 | 25.09 | 25.06 | 25.03 | 24.12 | 24.09 | 24.06 | ||

| 101 | 픽 | -0.88 | -0.12 | 1.85 | 0.70 | 0.72 | 0.77 | N/A | 3.97 | -0.51 | 0.29 | 4.44 | 57 | -285 | -102 | 238 | 117 | -34 |

| 102 | 케 | -0.95 | 5.43 | 3.38 | 0.73 | 1.00 | 1.36 | N/A | 2.69 | 1.64 | 23.02 | 1.76 | -55 | -126 | -87 | 195 | -24 | -35 |

| 103 | 아 | -1.23 | -9.10 | -10.51 | 1.45 | 1.09 | 1.28 | N/A | -40.06 | -0.68 | 2.19 | -12.82 | 133 | 193 | 27 | -378 | -40 | -131 |

| 104 | 원 | -1.27 | -0.96 | 3.33 | 3.09 | 0.51 | 0.48 | N/A | -7.70 | -2.51 | 9.49 | 11.25 | 314 | -99 | 72 | -450 | -69 | -107 |

| 105 | 엑 | -1.56 | 2.89 | 9.38 | 1.86 | 1.15 | 1.14 | N/A | -0.77 | 3.35 | 10.51 | 25.67 | -58 | -132 | -120 | 104 | -414 | 617 |

| 106 | 두 | -1.59 | 10.95 | 13.77 | 2.87 | 1.71 | 2.04 | N/A | 9.90 | 12.16 | 16.89 | 17.97 | 149 | -44 | -848 | 396 | 308 | 1,330 |

| 107 | 디 | -1.73 | 2.39 | 5.66 | 1.41 | 1.21 | 1.41 | N/A | 0.41 | 6.03 | 3.83 | 7.45 | -85 | -94 | -38 | -1 | -88 | -22 |

| 108 | 비 | -2.19 | 2.46 | 2.69 | 2.42 | 2.71 | 2.82 | N/A | -3.13 | 1.66 | 13.69 | 24.64 | 118 | 10 | -93 | -167 | -41 | -13 |

| 109 | 엘 | -2.77 | 9.07 | 8.16 | 0.98 | 1.09 | 1.21 | N/A | 0.66 | 20.81 | 11.69 | 10.55 | -88 | 120 | -355 | -52 | -108 | 108 |

| 110 | 엠 | -2.93 | -7.10 | -1.31 | 0.57 | 0.64 | 0.71 | N/A | -7.81 | -9.35 | -2.96 | 8.39 | -55 | 230 | 17 | -718 | 101 | -353 |

| 111 | 테 | -3.46 | -2.33 | -5.88 | 0.39 | 0.35 | 0.54 | N/A | -0.47 | 0.00 | -11.51 | 1.79 | -18 | -106 | -27 | 3 | -14 | -63 |

| 112 | 램 | -4.14 | -1.83 | 2.18 | 1.19 | 1.38 | 1.61 | N/A | -5.33 | -5.91 | 11.74 | 7.32 | -35 | -9 | -14 | -77 | -47 | -5 |

| 113 | 서 | -4.61 | 3.93 | 7.94 | 0.42 | 0.64 | 0.79 | N/A | 2.41 | 3.09 | 13.85 | 17.29 | -203 | 27 | -83 | 34 | -16 | 133 |

| 114 | 신 | -4.74 | 4.14 | -0.49 | 1.41 | 1.56 | 1.94 | N/A | -5.91 | 6.67 | 16.18 | -7.65 | -16 | 1 | -34 | -10 | -47 | -30 |

| 115 | 네 | -5.33 | -8.24 | -2.61 | 1.28 | 1.17 | 1.73 | N/A | -17.34 | -13.43 | 10.02 | 12.24 | -50 | 135 | -98 | -710 | -498 | -1,123 |

| 116 | 아 | -5.59 | -5.61 | -3.36 | 2.56 | 3.83 | 3.83 | N/A | -12.55 | -8.76 | -5.67 | 0.00 | 276 | -99 | -151 | -237 | -61 | -111 |

| 117 | S | -5.78 | 1.22 | 4.91 | 2.44 | 1.68 | 2.09 | N/A | 4.29 | -2.88 | 9.42 | 13.22 | -30 | -43 | -35 | -56 | 69 | 8 |

| 118 | 오 | -5.79 | 0.83 | 1.99 | 0.27 | 0.36 | 0.46 | N/A | 4.35 | 2.40 | -3.28 | 3.21 | 37 | -68 | 33 | -617 | -36 | 73 |

| 119 | K | -5.80 | -4.24 | -5.52 | 0.45 | 0.75 | 1.09 | N/A | -3.26 | -10.93 | 7.35 | 3.52 | -37 | -19 | -11 | -31 | -27 | 5 |

| 120 | 테 | -6.05 | -0.27 | 4.69 | 8.37 | 5.81 | 4.16 | N/A | -10.95 | -4.29 | 14.09 | 8.28 | -165 | 576 | -36 | -698 | 391 | -30 |

| 121 | 아 | -6.30 | -2.77 | 1.02 | 4.54 | 2.26 | 2.22 | N/A | -7.06 | 1.15 | 3.74 | 9.63 | 86 | -62 | -56 | -96 | -42 | -13 |

| 122 | 아 | -6.30 | -1.37 | -0.82 | 4.12 | 3.90 | 3.90 | N/A | 6.25 | -2.70 | 0.00 | 0.00 | -86 | -103 | 20 | 16 | -229 | 369 |

| 123 | 에 | -8.17 | -7.79 | -2.01 | 3.72 | 2.18 | 2.02 | N/A | -10.87 | -10.88 | 3.57 | 9.31 | 218 | -238 | -123 | -642 | -313 | -165 |

| 124 | L | -8.95 | -2.64 | 4.76 | 0.79 | 1.03 | 1.60 | N/A | -9.64 | -6.01 | 14.95 | 14.23 | -41 | -184 | -62 | -281 | -155 | -33 |

| 125 | 텔 | -9.37 | 7.98 | 6.56 | 1.17 | 1.30 | 1.58 | N/A | -19.11 | 25.44 | 27.05 | 6.62 | -271 | -213 | -230 | -463 | -644 | -1,032 |

| 126 | 피 | -9.79 | -0.12 | 1.04 | 0.85 | 0.95 | 1.04 | N/A | -4.64 | 2.13 | 16.81 | 7.14 | -18 | -87 | -23 | -1 | -43 | 6 |

| 127 | 코 | -10.98 | -20.83 | -12.51 | 5.04 | 3.15 | 2.70 | N/A | -7.95 | -44.01 | -11.44 | 7.06 | -68 | -60 | -45 | -131 | -143 | 11 |

| 128 | 와 | -11.46 | -14.30 | -8.58 | 5.08 | 3.22 | 3.12 | N/A | -35.93 | -10.01 | 6.17 | -2.94 | -102 | 327 | -179 | -556 | -563 | -179 |

| 129 | 엔 | -11.82 | -2.07 | -7.42 | 1.03 | 0.93 | 1.20 | N/A | -4.60 | 2.88 | -0.66 | -4.23 | -15 | -20 | -7 | -20 | -18 | 6 |

| 130 | 지 | -15.14 | -13.20 | -11.31 | 2.46 | 2.59 | 3.19 | N/A | -3.76 | -12.53 | -17.82 | -12.71 | -12 | -8 | -61 | -78 | -16 | 5 |

| 131 | 에 | -16.08 | 1.96 | 1.18 | 1.40 | 1.30 | 1.30 | N/A | -9.13 | 4.85 | 21.55 | 9.05 | -423 | -504 | -450 | -228 | -304 | -95 |

| 132 | 아 | -17.94 | -5.37 | -3.22 | 1.77 | 2.09 | 2.09 | N/A | -13.54 | -27.33 | 0.00 | 0.00 | -68 | -113 | -67 | -110 | -115 | -57 |

| 133 | H | -18.04 | 0.89 | -2.92 | 1.79 | 1.42 | 2.89 | N/A | -5.02 | 0.00 | 48.71 | 3.82 | -67 | -69 | -65 | -71 | -40 | -3 |

| 134 | 가 | -20.22 | 3.63 | 2.18 | 14.13 | 9.32 | 9.01 | N/A | 10.86 | 10.23 | 8.12 | 0.00 | -516 | -352 | -485 | 414 | 144 | 131 |

| 135 | 유 | -20.51 | -7.85 | -5.71 | 2.63 | 2.02 | 2.51 | N/A | -22.35 | 4.57 | -3.74 | -3.97 | 25 | -276 | -206 | -599 | 28 | -348 |

| 136 | 알 | -21.16 | -52.91 | -34.85 | 2.74 | 1.10 | 1.01 | N/A | -23.25 | -68.66 | -103.07 | -10.26 | 268 | -397 | -66 | -1,768 | 310 | -289 |

| 137 | 케 | -23.35 | -14.61 | -8.77 | 1.47 | 2.06 | 2.06 | N/A | -31.69 | -35.64 | 0.00 | 0.00 | -79 | -80 | -72 | -320 | -162 | -144 |

| 138 | 덕 | -25.14 | -11.09 | -3.80 | 2.31 | 2.56 | 2.49 | N/A | -26.78 | -4.18 | 8.53 | 10.35 | -667 | -258 | -502 | -586 | -154 | -1,700 |

| 139 | 마 | -25.96 | -10.95 | -6.57 | 2.82 | 2.11 | 2.11 | N/A | -25.96 | -23.43 | 22.21 | 21.12 | 0 | -235 | 90 | -448 | -117 | -384 |

| 140 | 윈 | -26.67 | -38.55 | -24.94 | 1.15 | 1.55 | 1.55 | N/A | -45.34 | -71.26 | -2.06 | -12.55 | -16 | -47 | -24 | -65 | -66 | -93 |

| 141 | 라 | -27.87 | -22.60 | -13.56 | 8.51 | 9.19 | 9.19 | N/A | -40.15 | -33.09 | 7.82 | -55.80 | -54 | 5 | -87 | -53 | -93 | -53 |

| 142 | 인 | -30.56 | -14.64 | 6.66 | 5.83 | 5.17 | 5.62 | N/A | -26.09 | -19.31 | 24.31 | 44.56 | -387 | 82 | -389 | -173 | -249 | -329 |

| 143 | 지 | -33.34 | -29.95 | -19.02 | 1.91 | 2.91 | 3.04 | N/A | 3.85 | -36.28 | -41.45 | -0.35 | -47 | -72 | -4 | 0 | 0 | 25 |

| 144 | 사 | -33.50 | -16.77 | -9.71 | 24.56 | 13.80 | 13.80 | N/A | -103.86 | -121.03 | 65.70 | -0.30 | -106 | -274 | -209 | 73 | -103 | -60 |

| 145 | 씨 | -35.13 | 0.00 | 0.00 | 10.06 | 10.06 | 10.06 | N/A | -35.13 | 4.74 | -0.05 | 0.00 | 1,862 | -7,867 | 0 | 0 | 0 | 666 |

| 146 | A | -35.59 | 0.56 | -1.79 | 0.41 | 0.77 | 1.01 | N/A | -0.66 | 6.09 | 4.66 | 11.69 | 59 | -323 | 3 | -3,133 | 116 | 2,537 |

| 147 | 시 | -37.57 | -16.78 | -10.07 | 1.47 | 1.50 | 1.50 | N/A | -24.19 | -19.10 | -36.94 | -35.52 | -308 | -438 | -320 | -351 | -333 | -281 |

| 148 | 퀄 | -41.06 | -16.67 | -10.42 | 4.12 | 8.52 | 8.52 | N/A | -37.61 | -29.25 | 57.25 | 95.98 | -352 | -397 | -339 | -260 | -422 | -380 |

| 149 | 에 | -43.20 | -10.80 | -6.48 | 5.05 | 4.92 | 4.92 | N/A | -16.62 | 3.72 | 156.70 | 0.00 | -564 | -472 | -761 | -820 | -484 | -162 |

| 150 | 레 | -63.54 | -18.41 | -11.05 | 1.77 | 1.97 | 1.95 | N/A | -29.15 | -0.50 | -11.74 | 0.00 | -289 | -415 | -286 | -237 | -274 | -222 |

| 151 | 에 | -71.28 | -36.35 | -19.27 | 5.83 | 2.10 | 1.90 | N/A | -91.82 | -16.98 | 2.69 | 3.76 | 40 | -4 | -90 | -877 | 92 | -271 |

| 152 | 오 | -85.45 | -89.58 | -53.75 | 8.29 | 17.68 | 16.69 | N/A | -44.94 | -72.22 | -78.22 | -71.08 | -226 | -356 | -256 | -471 | -115 | -264 |

| 153 | 하 | -92.44 | -76.23 | -48.08 | 7.70 | 12.22 | 11.08 | N/A | -125.46 | -60.89 | -38.35 | -61.04 | -81 | -76 | -75 | -70 | -100 | -101 |

| 154 | 피 | -101.61 | -34.14 | -15.68 | 2.09 | 1.29 | 1.33 | N/A | -46.00 | -12.24 | -10.55 | 14.11 | -296 | -443 | -368 | -706 | -197 | -308 |

| 155 | 시 | -103.22 | -37.81 | -24.86 | 1.47 | 1.04 | 1.09 | N/A | -73.58 | -13.08 | 5.74 | 13.76 | -45 | -33 | -129 | -380 | -89 | -62 |

| 156 | 젬 | -118.72 | -86.61 | -50.63 | 32.67 | 15.83 | 11.49 | N/A | -300.69 | -25.16 | -14.59 | 7.83 | -60 | -38 | -222 | -1,168 | -205 | 55 |

| 157 | 세 | -207.94 | 0.00 | 0.00 | 8.18 | 8.18 | 8.18 | N/A | -207.94 | -36.03 | -42.96 | 0.00 | -285 | 0 | 0 | 0 | 919 | -10,462 |

| 158 | 테 | -244.43 | 0.00 | 0.00 | 46783.97 | 46783.97 | 46783.97 | -244.43 | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A |

| 159 | 넥 | -99999.99 | -179.21 | -99.56 | -104.28 | 15.43 | 13.23 | N/A | -234.75 | -91.02 | -68.88 | -66.10 | -277 | -198 | -260 | -278 | -196 | -226 |

12

12 - 01 기업의 강점을 한 눈에! 종목진단, 재무분석차트

- 02 투자는 타이밍! AI주가예측, 업데이트 알림

- 03 특허받은 알고리즘의 적정주가

- 04 전 종목 기업분석을 위한 20년 재무제표

- 05 투자자를 위한 종목 스크리닝, 데이터 다운로드